city of richmond property tax bill

16-17 Personal Property Tax Bills. If you do not receive a bill it is your responsibility to investigate whether you have a liability to the Town.

Printable Sample Late Rent Notice Form Being A Landlord Late Rent Notice Real Estate Forms

Broad St Rm 802 Richmond VA 23219 Phone.

. All late payments accrue interest. Real Estate and Personal Property Taxes Online Payment. Manage Your Tax Account.

Business License - City of Richmond Instructions for Business License Online Payments httpsetrakitcirichmondcaus Parking Tickets - T2 Systems https. 804 646-7500 Fax. 295 with a minimum of 100.

1000 x 120 tax rate 1200 real estate tax. 804 646-5686 1999-2022 City of Richmond Virginia. Broad St Rm 802 Richmond VA 23219 Phone.

We do not charge you to use the online payment system. For more information contact BC Assessment at 1-866-825-8322 or wwwbcassessmentca. Greater Vancouver Transportation Authority TransLink 604-953-3333.

PAY YOUR PERSONAL PROPERTY TAXES ONLINE OR BY MAIL. Electronic Check ACHEFT 095. 804 646-7500 Fax.

City Treasurer Armstead and Deputy Treasurer Morris. Richmond City Assessors Office 900 E. Understanding Your Tax Bill.

City Hall cashiers are open for utility bill and property tax payments. Tax bills are mailed in the month of July. 3 Road Richmond British Columbia V6Y 2C1.

Billing is on annual basis and payments are due on December 5 th of each year. By Richmond City Council. Search by Property Address Search property based on street address.

Real Estate taxes are assessed as of January 1 st of each year. To create an online payment of the Richmond property tax bill we must select the Proceed to Payment option in the Inquiry section. Personal property tax bills have been mailed are available online and currently are due June 5 2022.

Due Dates and Penalties for Property Tax. Broad Street Richmond VA 23219. Payments may not be scheduled for a later date.

Team Papergov 1 year ago. Personal Property Taxes are billed once a year with a December 5 th due date. City of Richmond Community Information Facebook Page.

You can make your tax payments 24 hours a day seven days a week. Search by Parcel ID Parcel ID also known as Parcel Number or Map Reference Number used to indentify individual properties in the City of Richmond. Interest is assessed as of January 1 st at a rate of 10 per year.

Online Assessor Data Cards Tax Club Application. Parcel ID Address Land Value. Demystifying Property Tax Apportionment httpstaxcolpcocontra-costacaustaxpaymentrev3summaryaccount_lookupjsp.

Interactively search the Citys property database here using criteria eg. Monday - Friday 8am - 5pm. 15-16 Commitment Book Name 15-16 Commitment Book PP Name 15-16 Commitment Book MapLot.

Personal Property Taxes are assessed on any vehicle motorcycle boat trailer camper aircraft motor home or mobile home owned and registered as being garaged in Richmond County as of January 1 st of each tax year. Province of BCs Tax Deferment Program. Failure to receive a tax bill does not relieve you of the penalty and the interest on a past due bill.

21-22 Commitment Book Name 21-22 PP. The vision of the Richmond City Treasurers Office is to resurrect a greater sense of purpose between the Richmond banking industry and the Central Virginia community at large by expanding the knowledge understanding and self-reliance of individuals and their personal finances. City of Richmond Tax Department 6911 No.

Informal Formal Richmond City Council Meetings - June 13 2022 at 400 pm. Municipal Finance Authority 250-383-1181 Victoria. Please note that failure to receive a tax bill does not negate the requirement to pay the tax.

If you have difficulty in accessing any data you may contact our customer service group by calling 804 646-7000. Property Tax Vehicle Real Estate Tax. The City Assessor determines the FMV of over 70000 real property parcels each year.

This utility allows a person to interactively search the City of Richmond real property database on criteria such as Parcel ID Address Land Value Consideration Amount etc. Property Value 100 1000. Property Pre-Authorized Withdrawal Changes or Cancellations.

This will change your mailing address for your Property Assessment Notice Property Tax Notice and your Utility Bills. When you pay you will get a reference number as proof of your payment. To contact City of Richmond Customer Service please call 804-646-7000 or 3-1-1.

If you are disputing the assessment of your tax you are required to pay the original amount. Richmond City Assessors Office 900 E. All payments made before 5 pm EST are effective the same day they are authorized.

Taxpayers can either pay online by visiting RVAgov or mail their payments. 3 Road Richmond BC V6Y 2C1. Late payment penalty of 10 is applied on December 6 th.

Personal Property Registration Form An ANNUAL filing is required on all personal property items located in. Richmond City Assessors Office 900 E. Tax Bill General Information.

As June 5 falls on a Sunday all payments postmarked on or before June 6 will not be subject to penalties and interest for late payment. Paying Your Property Taxes. The real estate tax is the result of multiplying the FMV of the property times the real estate tax rate established.

Property value 100000. Tax Collector - Town of Richmond Maine. Contact the City of Richmond Tax Department at 604-276-4145 for further information about PAWS.

Only the registered property owner is allowed to change the mailing address. Payment of Property Tax with Credit Card in Richmond If we want to pay our tax bill by credit card we select the credit card option then we fill in the box of the amount we want to pay and click on the Continue to Payment Information button. For information and inquiries regarding amounts levied by other taxing authorities please contact them directly at.

For commercial tenants wanting to change the mailing address of a utility bill contact the City of Richmond Tax Department at 604-276-4145 or TaxDeptrichmondca.

3211 Nevin Avenue North East Richmond Ca Compass Wall Furnace House Prices Richmond

Access Denied Ridgewood Property Records View Photos

3130 Ponderosa Way Antioch Ca Compass Ranch Style Home Antioch House Prices

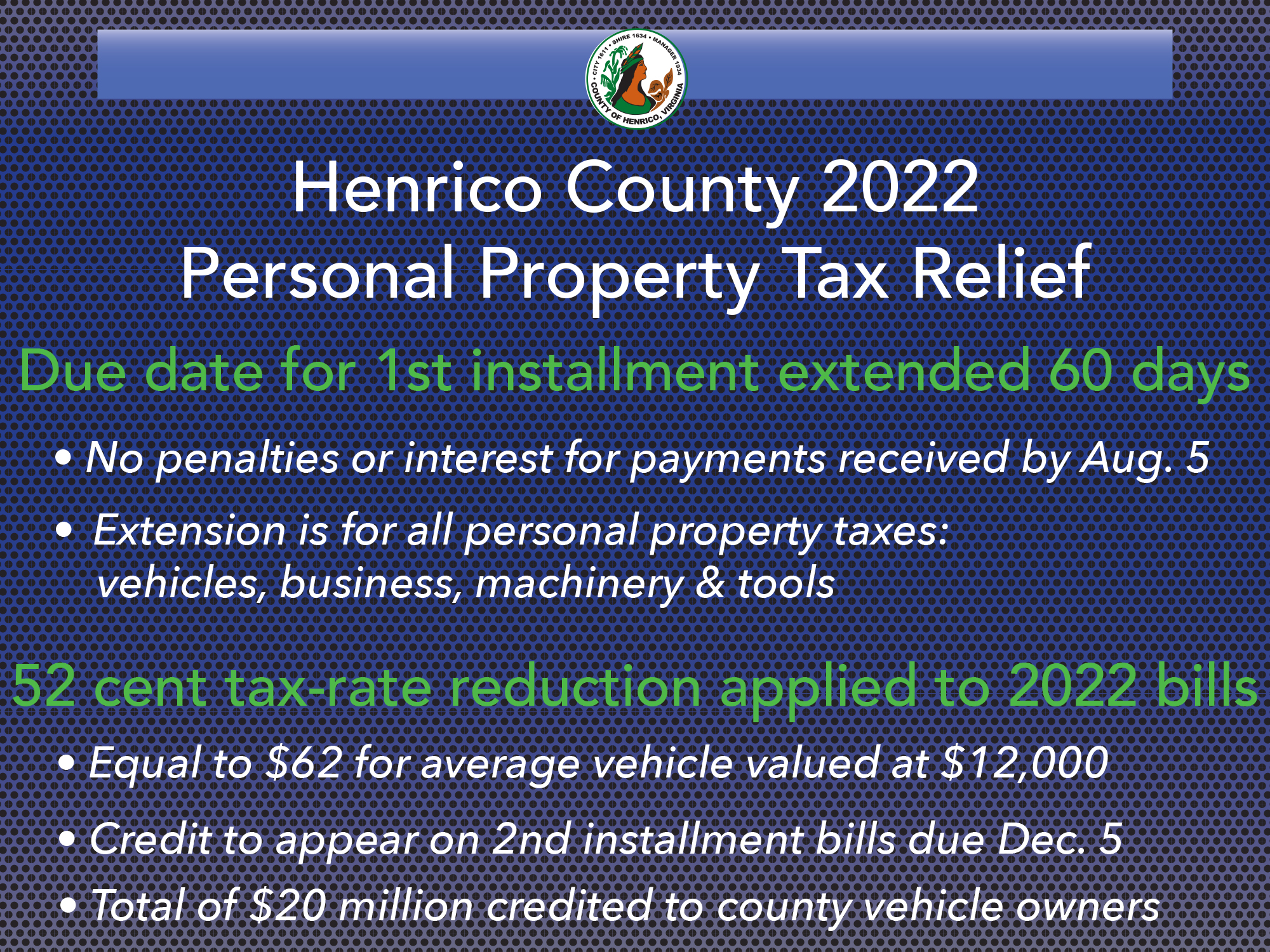

City Of Richmond Extends Personal Property Tax Deadline To August Wric Abc 8news

2100 Fuente Court Antioch Ca Compass Antioch Range Cooktop Building A House

/cloudfront-us-east-1.images.arcpublishing.com/gray/4ASPKZIKKZEKDBCSG3BYAZNXBM.jpg)

Richmond Personal Property Tax Payment Deadline Extended Until Aug 5

Mls 785185 825 E High Street Springfield Oh 45505 Dayton Realtors Old House Dreams Victorian Home Interior Victorian Homes

Fine Tax Lawyer Columbus Ohio In 2022 Tax Lawyer Tax Attorney Criminal Law Attorney

Richmond Property Tax 2021 Calculator Rates Wowa Ca

Pay Online Chesterfield County Va

9 Willow Hill Rd Ross Ca 94957 Zillow House Styles Mansions Home Family

Pin On Treasure Chest Thursday

Staples Mill Pond Richmond Virginia Pond

Pin By Gvanwage On Lawyers Title Frisco Tx 75034 Title Insurance Dfw Real Estate Best Titles

Henrico Proposes Personal Property Tax Relief To Offset Rising Vehicle Values Henrico County Virginia

/cloudfront-us-east-1.images.arcpublishing.com/gray/4ASPKZIKKZEKDBCSG3BYAZNXBM.jpg)

Richmond Personal Property Tax Payment Deadline Extended Until Aug 5

Service After Sale The Houston Region To All Of My Buyers Request To Correct Name Or Address On A Real Property Accoun Harris County Tax Forms Accounting

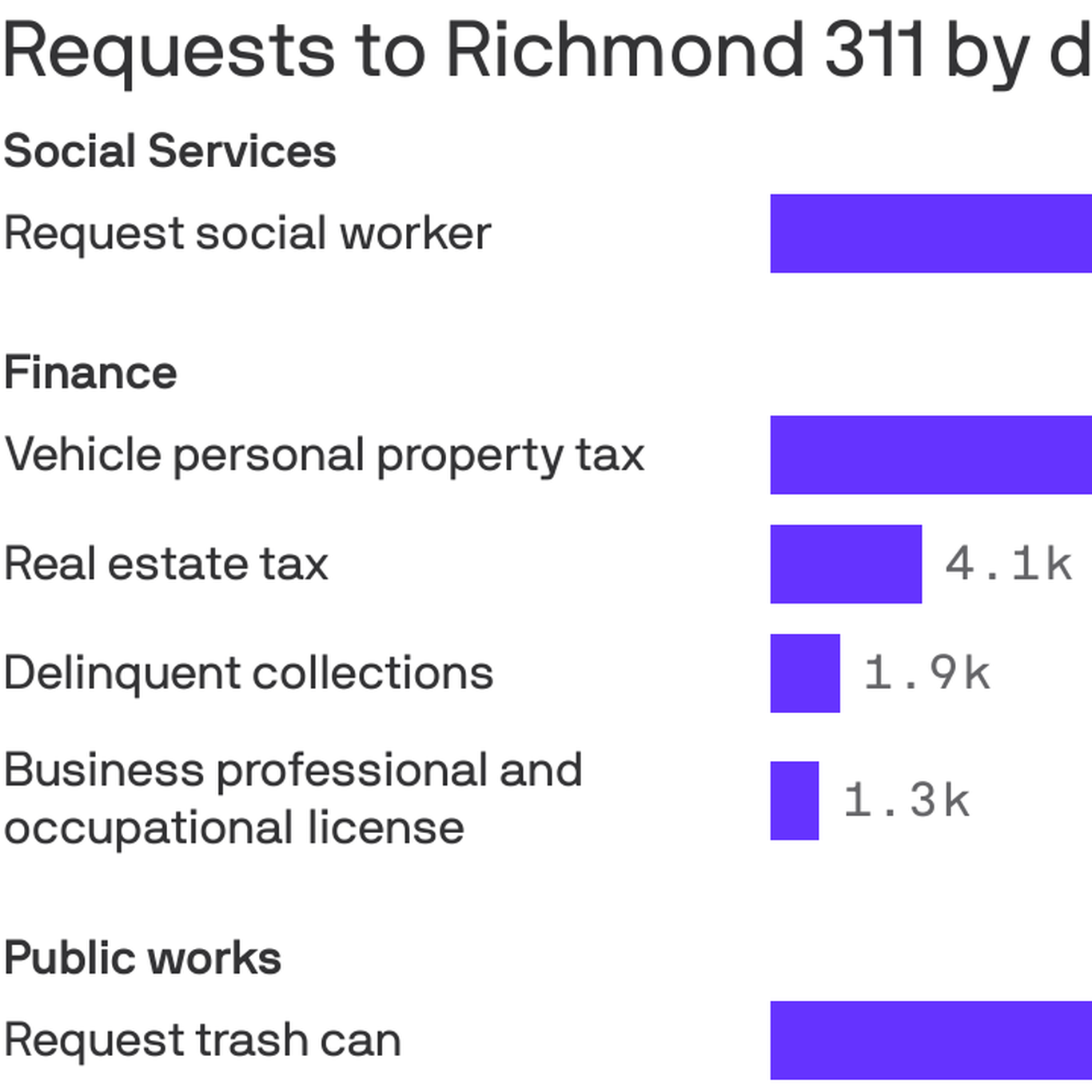

In Richmond Social Services Dominate 311 Requests Axios Richmond